For investors looking for better potential return opportunities and diversification benefits, we see three reasons to venture beyond U.S. stocks.

International small caps offer a big opportunity For American investors, a home country bias has paid off in recent years. But when considering longer time horizons, we believe global diversification is the best way to achieve consistently attractive risk-adjusted returns. One well-respected proxy for global equity markets is the MSCI ACWI Investable Market Index (ACWI IMI), which tracks more than 8,600 large, mid, and small cap companies across both developed and emerging markets. This index represents about 99% of the global equity investment opportunity set. International small cap stocks comprise 10% of the ACWI IMI, although most investors in the U.S. tend to overlook this asset class and allocate far less to it. In our view, it deserves more consideration. |

1. Diversification with more upside

International diversification offers U.S.-based investors enhanced return potential and reduced portfolio risk—two things that are especially attractive during periods of economic uncertainty or regional underperformance.

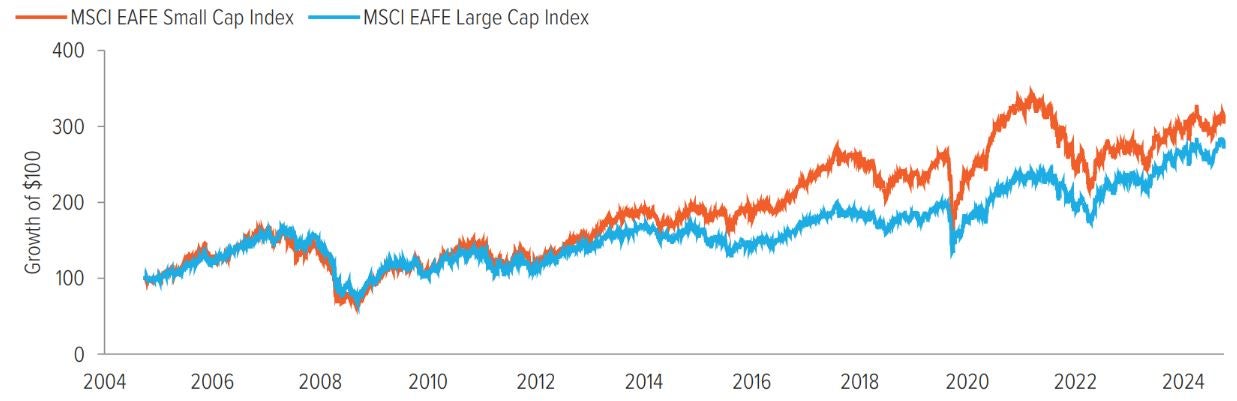

International small caps and international large caps both have similar correlations to U.S. large cap equities over the past two decades (0.85 and 0.86, respectively); however, international small caps have produced higher long-term returns than international large caps—on both a total and risk-adjusted basis (as measured by the Sharpe ratio) (Exhibit 1). Shifting a portion of a portfolio’s international large cap equity allocation to international small cap equity does not materially alter the diversification benefits—but has historically increased upside potential, thereby modestly boosting overall risk-adjusted returns. For investors looking for better potential return opportunities and diversification benefits, we see three reasons to venture beyond U.S. stocks and explore international small caps.

As of 03/31/25. Source: Morningstar, Voya IM. The MSCI EAFE Small Cap Index measures the performance of small-capitalization companies across developed market countries around the world excluding the U.S. and Canada. The MSCI EAFE Large Cap Index measures the performance of large-capitalization companies across developed market countries around the world excluding the U.S. and Canada. Past performance does not guarantee future results. Investors cannot invest directly in an index.

As of 12/31/24. Source: Morningstar. Standard deviation is a formula that predicts potential future volatility of performance. High deviation suggests the outcome could be very different from historical averages, while low suggests the outcome could be closely matched. The Sharpe ratio measures risk-adjusted return, or how much excess return is received in exchange for the extra volatility associated with investing in a riskier asset.

2. Greater evidence of a size premium

The size premium refers to the additional compensation that investors demand from smaller companies due to their lower liquidity, higher volatility, and greater sensitivity to economic downturns.

Within U.S. equities, the size premium has diminished in recent years. Why? One reason is that larger firms have benefited disproportionately from access to cheap capital, locking in lower interest rates from a longer time, allowing them to expand efficiently and improve their profitability.

Additionally, investor demand has increased for U.S. large cap technology and growth stocks (which have dominated market returns), reducing the relative attractiveness of small stocks.

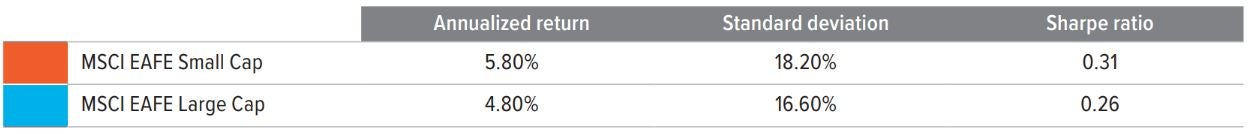

Within international equities, however, evidence of the size premium is stronger (Exhibit 2). Over the last 20 years, investing in international small caps versus international large caps has resulted in positive excess returns, while investing in U.S. small caps versus U.S. large caps has resulted in negative excess returns.

As of 03/31/25. Source: Morningstar, Voya IM. The MSCI EAFE Index captures the performance of large and mid cap stocks across 21 developed market countries, excluding the U.S. and Canada. The Russell 1000 Index measures the performance of the highest-ranking 1,000 stocks in the Russell 3000 Index, an index that represents about 98% of the value of all U.S. equities. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. Past performance does not guarantee future results. Investors cannot invest directly in an index.

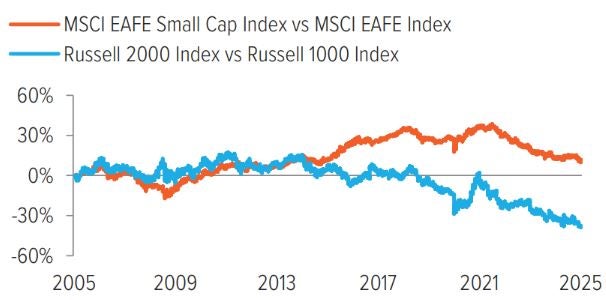

One reason for this may be that the quality of small cap companies outside the U.S. tends to be higher on average (as measured by return on equity) and other profitability metrics (Exhibit 3). Many international small cap companies—particularly those in developed countries with strong industrial bases—have more disciplined financial structures and are less reliant on speculative growth strategies. Within emerging markets, small companies often benefit from rapid economic growth and increasing domestic consumption, further supporting the persistence of the size premium.

As of 03/31/25. Source: FactSet, Voya IM. Past performance does not guarantee future results. Investors cannot invest directly in an index.

3. Attractive relative valuations

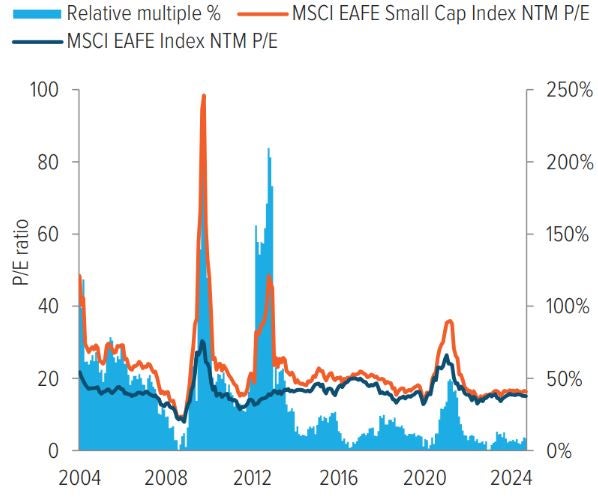

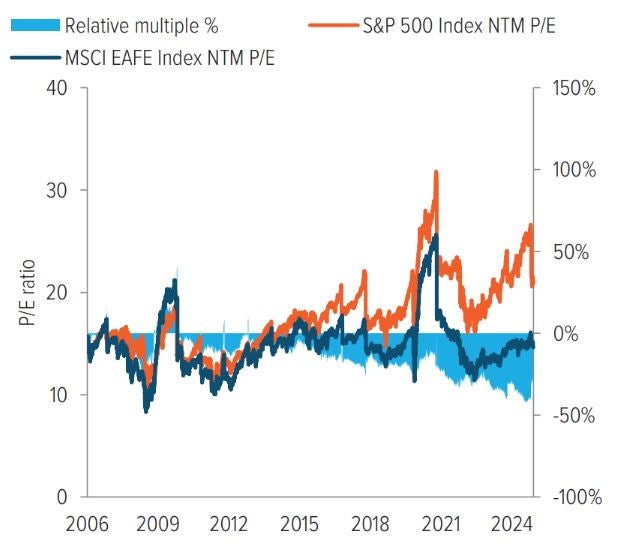

International small cap equities look cheap relative to both their large cap counterparts (Exhibit 4) and to U.S. equities (Exhibit 5) as measured by next twelve months’ (NTM) price-to-earnings (P/E) ratios.

In fact, the valuation discount between international equities and U.S. equities is currently at its largest in over 20 years. Historical data indicate that significant disparities in valuations can precede strong performance recoveries1 —making now an opportune time for investors to gain exposure to this asset class. Additionally, the valuation gap creates a margin of safety for investors, mitigating risk while increasing the potential for outsized returns.

As of 03/31/25. Source: Bloomberg Index Services, Ltd., FactSet, Voya IM. The S&P 500 Index measures the performance of about 500 of the largest U.S. companies. Next 12 months (NTM) price-to-earnings (P/E) ratio is the ratio of a company’s share price to its earnings using projected future financial performance for the next 12 months (rather than historical data), which can help determine whether a stock is under- or overvalued. Past performance does not guarantee future results. Investors cannot invest directly in an index.

A note about risk: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. Smaller companies may be more susceptible to price swings than larger companies, as they typically have fewer resources and more limited products, and many are dependent on a few key managers. International investing does pose special risks, including currency fluctuation, economic and political risks not found in investments that are solely domestic. Risks of foreign investing are generally intensified for investments in emerging markets.