Key Takeaways

Challenge: U.S. electricity demand is growing at its fastest pace in 40 years, driven primarily by the huge load demands of AI and data centers—and this is only going to intensify. A side effect is that electricity is getting more expensive everywhere.

Solution: New natural gas and renewable generation plus storage are in a strong position—both economically and technologically—to meet this rising demand.

Opportunity: Companies most likely to benefit from increased generation demand and higher electricity prices include independent power producers (near-term) and utilities (longer-term), as well as tech and industrials focused on optimizing electricity generation and distribution.

Winning the AI race may hinge less on algorithms and more on powering data centers, which are projected to double their electricity consumption in the next decade. The grid is nowhere near ready. Here’s what it means for equity investors.

The challenge: Ramping up a strained power grid to support AI growth

Here’s the situation …

1. The U.S. power grid is antiquated, and it’s already strained by current demand.

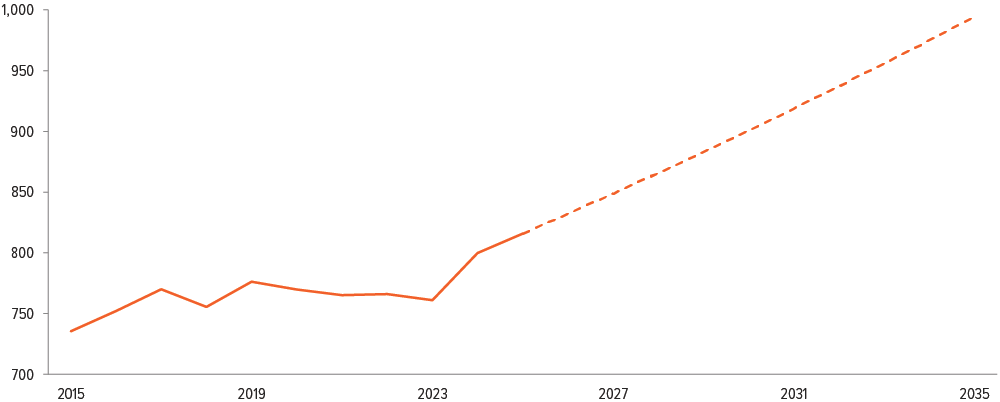

2. The data centers that enable new types of artificial intelligence consume a lot of energy, requiring more 24/7 power generation capacity (Exhibit 1).

3. Making progress in AI is both a national security issue and an economic imperative. So kicking the can is not an option.

4. Therefore, ipso facto, winning the AI race is inextricably intertwined with building new powerplants and continuing the growth of renewables.

As of 06/15/25. Source: NERC.

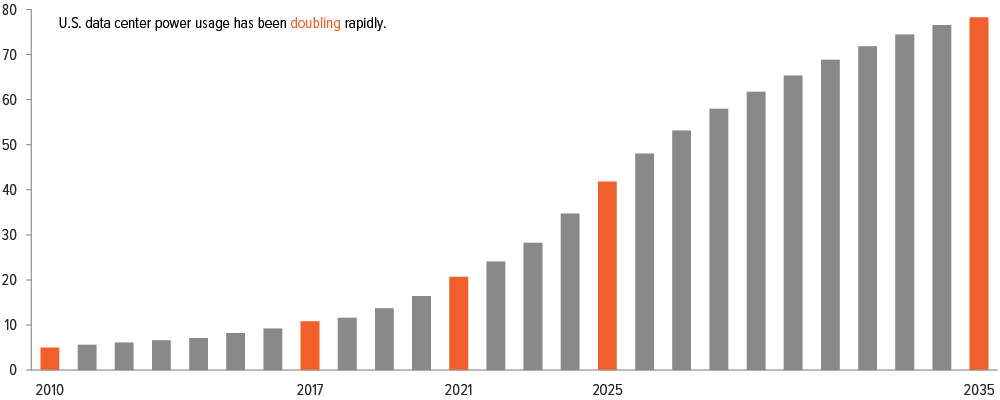

The boom in data center construction across the U.S. has been in full gear for over a decade, fueled first by the growth of cloud computing, and now by the rise of generative AI and large language models, where queries consume nearly 10 times the compute resources as a typical Google search.1 As a result, data center power consumption doubled from 2017 to 2021, and doubled again through 2025 (Exhibit 2). Bloomberg conservatively estimates that continued AI growth will drive another doubling in electricity consumption over the next decade.

As of 04/15/25. Source: BloombergNEF forecast, DC Byte.

There is also growing political backing to accelerate the speed of AI development as the U.S. and China battle for leadership in this critical area. The White House put a spotlight on the issue when the Trump administration announced its AI Action Plan on July 23rd, which includes resources for building out data centers, semiconductor fabrication plants, and the nation’s electric grid.

The surge in data centers and related power demand represent a seismic change for the power industry, which has experienced decades of relatively flat electricity use. For the first time since the early 2010s, U.S. electricity demand is rising, stemming from growing commercial consumption, which is poised to increase by 3% in 2025 and another 5% in 2026.2 And according to the International Energy Agency, half of all electricity demand growth in the U.S. will come from data centers.3

The problem is that building new generation capacity typically requires long lead times. And local grids are already strained, making power supply a key bottleneck for AI growth.

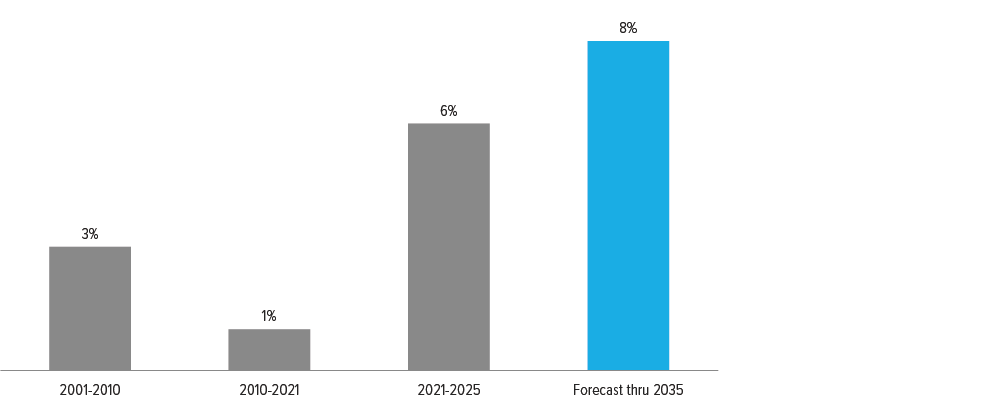

As electricity generation struggles to keep pace, prices are rising—a long-term trend that appears to be accelerating. Average electricity prices in June 2025 were 7% higher than in 2024, driven by increased demand and greater utility investment in grid infrastructure.4 Future projections suggest annual price increases of around 8%. Policy clarity has improved with the passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025, creating new opportunities for energy producers, infrastructure developers, and technology providers amid the shifting demand landscape.

Source: Powerlines, “Utility Bills Are Rising,” 04/25; ICF forecast, “Rising Current: America’s Growing Electricity Demand,” 05/28/25; Voya IM calculations.

The solution: Scaling power generation through an “all-of-the-above” approach

The foundation of AI growth is power. To meet the demand, the U.S. will need to tap every resource: solar, storage, geothermal, nuclear, and natural gas.

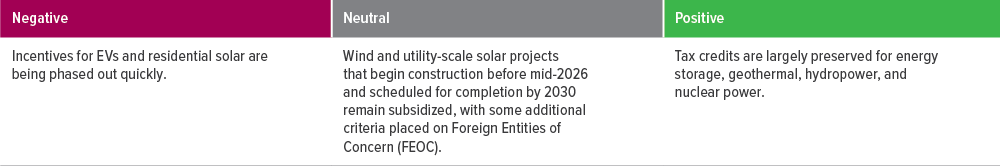

Over the last decades, renewable electricity generation in the U.S. has grown significantly.5 However, since before the 2024 election, the U.S. clean energy market has been volatile, underperforming the broader market through early 20256 amid significant policy uncertainty. In the lead-up to the passage of the OBBBA, clean energy stocks experienced a modest rebound. While the legislation reduces funding and tax credits compared to the Inflation Reduction Act (IRA), it was not as severe as initially feared.

As of 07/31/25. Source: Voya IM.

Renewables are cheap and relatively fast to build

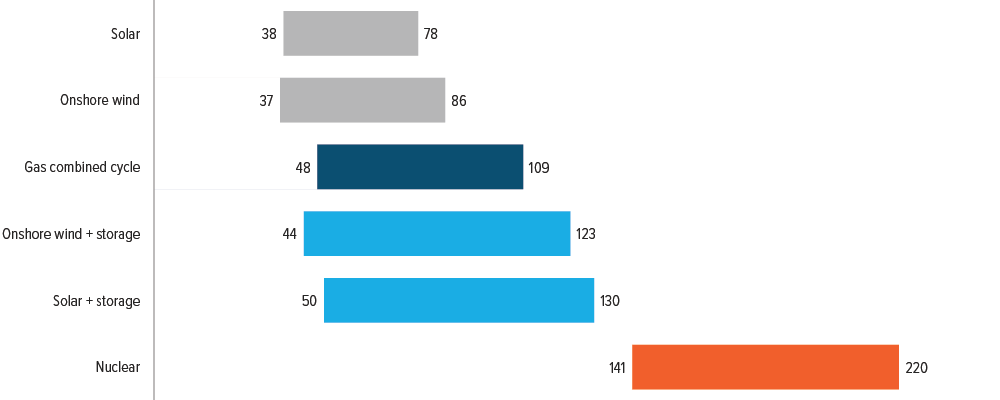

The cost competitiveness of utility-scale wind and solar have increased following a reduction in costs, corresponding to 70% and 85% since 2010 for wind and solar, respectively.7 Comparing across energy sources, levelized cost of electricity8 for utility scale solar spans the lower end of cost interval for natural gas and is far below the levelized cost of electricity for nuclear (Exhibit 3).

Levelized cost of energy, $/MWh

Another advantage over other energy sources such as nuclear and natural gas is time-to-power. Currently, among new power generation and storage projects seeking to connect to the electric grid an overwhelming majority comes from solar, wind, and storage. In line with this, despite the phase out of tax credits for renewable and remaining uncertainties policy uncertainties relating to the FEOC, we expect renewables continue to grow in the near-term, but slow down after 2027.

Batteries are getting better

Energy storage is critical to balancing intermittent renewables and meeting peak demand and geothermal and hydropower offer additional baseload options, particularly in regions with favorable geology or existing infrastructure. With subsidies available through 2033, and battery costs falling following reductions in lithium prices, storage is becoming more viable at scale. Similarly, geothermal and hydro power are increasingly seen as complements to solar and wind.

Gas is back

Electricity supply from natural gas corresponds to 42% of total supply and, like renewable energy, it has grown significantly over the last two decades.

With renewed investments and increased interest from policy makers, it is set to continue growing and to contribute to the powering the AI race. Gas turbine manufacturers have been reporting an uptick in orders, now with wait times up to seven years.9 Several large data center operators have announced partnerships with utilities and energy companies developing new gas-fired power capacity.

Nuclear seems to be viable again

Nuclear energy has also seen renewed interest and investments. Several hyperscalers have contracted nuclear power producers and are supporting the development and commercialization of small modular reactors. Nuclear is well positioned to provide 24/7, zero-carbon baseload power.

The opportunity: A long-term investment theme

Despite the policy turbulence of the past year, the outlook for U.S. clean energy, especially as it relates to AI infrastructure, is increasingly constructive. The OBBBA and executive order have reset expectations, but they have also preserved key incentives for some of the technologies relevant to the AI race.

Nuclear, storage, geothermal, and fuel cells all remain supported. Solar, while facing a compressed timeline, still seems to have a limited but viable path forward. The second pillar of the AI energy opportunity is infrastructure, transmission, grids and solutions that bring power generation closer to the point of use. Solutions are likely to be a mix of behind and in front of the meter, depending on the broader infrastructure and economics of each project.

The gating factor in the AI race is power and the investment opportunities are abound across the value chain. We view the main opportunities through five different investment areas, that are exposed to the increasing electricity demand.

Independent power producers (IPPs)

IPPs will continue to profit, an equally weighted basket of four of our IPP-holdings has grown 70% over the last 12 months, by generating power and selling it on the open market, directly benefitting from higher demand. Many IPPs have capacity to generate electricity from multiple sources, including renewable energy, nuclear and gas. They also make use of contracts both in front and behind the meter, where we have seen a recent surge in long term power supply contracts with hyperscalers.

Regulated utilities

While IPPs have outperformed regulated utilities to-date, the upside of regulated utilities is more gradual, and they are likely to benefit from growing power demand and investments in transmission and distribution, leading to higher rate base growth. There are also investment opportunities related to the utilities’ involvement in nuclear and natural gas generation capabilities, gas pipelines and storage.

Traditional energy

Companies in the traditional energy sector such as Williams or EQT, are also exposed. Both through the development and generation of natural gas, the need for infrastructure such as pipelines, and a growing possibility to scale carbon capture solutions across the value chain.

Industrials

Industrials providing electric power systems and specialized electricity related services are potential beneficiaries. Over the past year, an equally weighted basket of five industrial holdings active in this theme has grown by 90%. We see opportunity in companies involved in the production of batteries, and companies reducing carbon emissions via the growth of fuel cells, converting natural gas, biogas, and hydrogen into electricity without combustion.

Solar technology and grid efficiency

We see opportunities in technology and industrial companies that are helping to optimize solar generation, including measuring machines and semiconductors. Many data centers and tech companies remain committed to their decarbonization goals. Renewable energy investments, especially utility scale solar with domestic manufacturing capabilities, will continue to support the growing power demand. Similarly, solutions increasing grid capacity and efficiency in transmission and distribution, will benefit from the electricity demand growth and increasing power supply.

Implications for Voya portfolios

Powering AI is an enduring trend that continues to influence investment decisions across our equity portfolios. The recent policy clarity has increased our portfolio managers’ convictions in current positioning:

- Our large cap value team continues to expect upside for regulated utilities that will benefit from an overall increase in demand for electricity and grid investment, leading to higher rate base growth.

- Our midcap growth team has been investing in IPPs that are directly benefitting from increasing demand from hyperscalers, and they are maintaining exposure to natural gas exploration and services companies.

- Our thematic team, which manages a more targeted decarbonization strategy, sees opportunities across all the sectors mentioned above. Notably, they are investing in supporting technologies and equipment beyond the traditional utilities and energy space, as well as some pure play renewables companies.

A note about risk: The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer, and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. Smaller companies may be more susceptible to price swings than larger companies, as they typically have fewer resources and more limited products, and many are dependent on a few key managers.

Artificial intelligence (AI) may pose inherent risks, including but not limited to: issues with data privacy, intellectual property, consumer protection, and anti-discrimination laws; ethics and transparency concerns; information security issues; the potential for unfair bias and discrimination; quality and accuracy of inputs and outputs; technical failures and potential misuse. Users of AI-based technology and tools should take these risks into consideration prior to use of the technology.