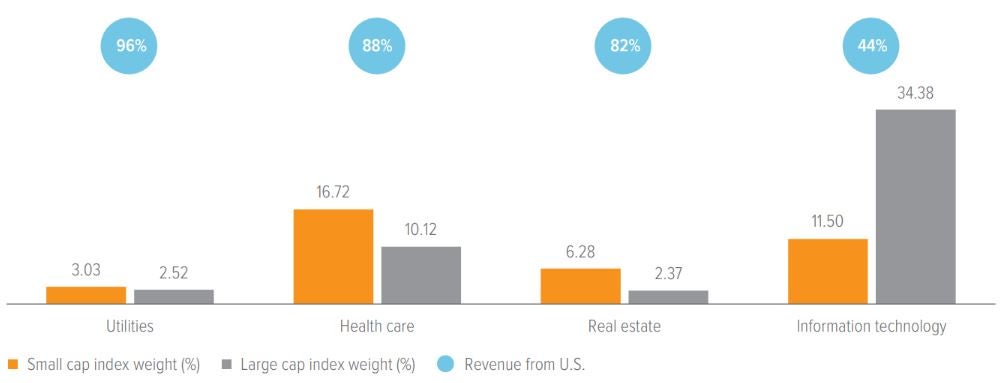

77% of small cap revenues come from within the United States, making them less vulnerable to trade wars.1

As of 02/03/25. Source: FactSet. Small caps represented by the Russell 2000 Index; Large caps represented by the Russell 1000 Index.

Small cap companies …

… are more likely to operate in sectors which derive most of their revenue from U.S. customers.

… have a drastically lower reliance on global sales, especially from the tech sector’s predominantly non-U.S. focus.

The big takeawayWhile small caps are more likely to generate revenue domestically and mitigate the risk of an export trade war, not all companies have the same level of home bias. Additionally, some companies that generate revenue within the U.S. may still purchase inputs from abroad, adding an extra layer of tariff risk. Since each company faces a different level of risk, active management and proprietary fundamental research are crucial components of our selection process. Our investment team conducts thorough analysis on many factors— such as tariffs—that may influence a company’s bottom line. |

A note about risk

The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. More particularly, growth-oriented stocks typically sell at higher valuations than other stocks. If a growth-oriented stock does not exhibit the level of growth expected, its price may drop sharply. Additionally, growth-oriented stocks have been more volatile than value-oriented stocks. More particularly, the Strategy invests in smaller companies, which may be more susceptible to price swings than larger companies, as they companies typically have fewer resources and more limited products, and many are dependent on a few key managers.