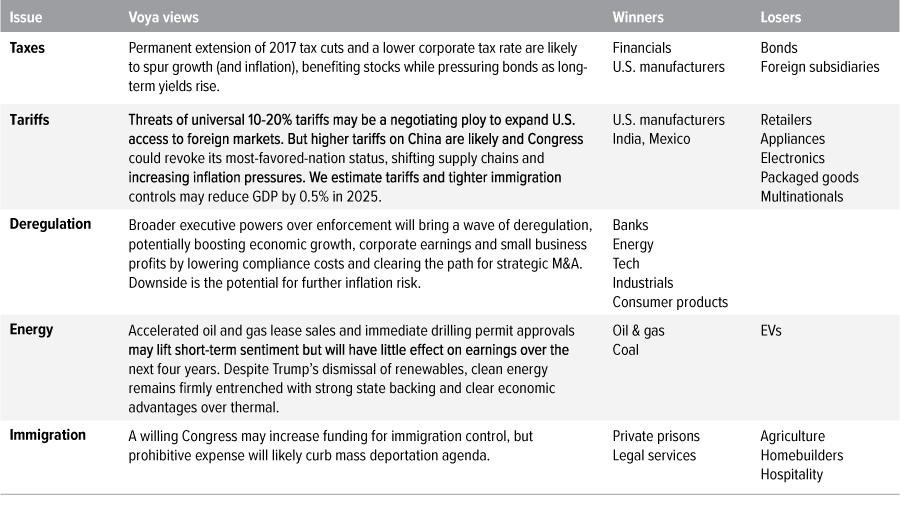

President-elect Donald Trump is set to reshape America around lower taxes, higher tariffs, less regulation, more drilling and fewer immigrants. At the time of publication, the House race is too close to call, but Republicans appear on the verge of controlling both chambers of Congress. Here’s what it means for markets.

1. Full extension of 2017 tax cuts positive for growth

With Congressional support, Trump is poised to leave a lasting mark on the U.S. tax code, making key provisions of his Tax Cuts and Jobs Act permanent, including lower individual tax rates and immediate expensing of capital equipment investments and research costs (“bonus depreciation”). Trump has also stated that he wants to lower the corporate tax rate to 15% for U.S. manufacturers and to make tip income nontaxable.

These tax cuts will contribute to meaningful deficit growth and, together with rising federal debt service costs, will lead to a further increase in the budget deficit. The Treasury market seems only occasionally concerned about the budget deficit these days, but it could become a more acute focus at some point.

Implications: Good for stocks, as a lower corporate tax rate could benefit capital-intensive businesses such as manufacturers, financials and sectors with high R&D expense, including pharma and tech. Less good for bonds, as higher growth and inflation expectations could steepen the yield curve, led by higher back-end yields.

2. Higher China tariffs may shift supply chains and raise inflation risks

Trump has been a staunch proponent of using tariffs to tackle unfair trade practices and boost domestic production. Presidents can impose tariffs up to 50%, and with full congressional backing Trump could threaten even higher rates. But which threats are genuine and which are simply negotiating tactics?

A universal 10-20% tariff on all imports would violate many existing trade agreements and provoke retaliation. His willingness to grant exemptions suggests an effort to broaden access to foreign markets. For China, however, higher tariffs signal a strategic shift away from an increasingly adversarial government.

As America’s third-largest trading partner, China accounted for nearly $500 billion a year in imports during the Trump and Biden administrations.1 Biden largely maintained Trump’s China tariffs, currently 19.3% (compared with a 3.0% average for other countries).2 Further increasing these tariffs and, with the backing of Congress, revoking China’s most favored nation status would cause major ripples across global supply chains, potentially shifting more manufacturing to countries such as India, Mexico and Canada, and boosting domestic production.

Implications: Trump’s first-term tariffs had relatively limited direct economic impacts, with retaliatory measures offsetting increased U.S. duties and widening the trade deficit by 55%, from $40 billion in 2016 to $62 billion in 2020.3 Tariffs are often called "shadow taxes" on importers, who pass costs to consumers through higher prices. Moreover, with the economy at full employment, the challenge of filling domestic jobs could drive wage inflation, pushing overall goods and services prices higher.

Higher tariffs can have far-reaching and unexpected consequences. They can increase the cost of tech components and drive up mortgage rates. Sectors that produce durable goods such as home appliances, consumer electronics and toys could be the hardest hit. But even services and nondurable manufacturing sectors like food, beer and clothing could also face negative impacts, along with multinational corporations, retailers and auto manufacturers. Yields on Treasury bonds could rise as a result of higher inflation expectations.

3. Don’t underestimate the significance of the coming deregulation wave

The U.S. Supreme Court’s recent reversal of Chevron deference4 will hand Trump sweeping authority to roll back regulations. For example, by emphasizing a narrower interpretation of regulatory powers, the EPA could relax methane emission rules on oil and gas producers. Financial services companies could get relief from Dodd-Frank (although the Federal Reserve has already relaxed capital requirements). And the Federal Trade Commission will see a regime change that could take a softer stance on antitrust enforcement and usher in a wave of mergers and acquisitions.

Deregulation also promises benefits for small business owners, for whom regulatory compliance is often the biggest cost. Changes in regulatory enforcement could streamline tax filing, ease wage and hour requirements, allow access to lower-cost health care plans and reduce environmental and worker safety costs.

Implications: We believe the market has yet to fully bake in the power of a post-Chevron ethos converging with an administration focused on deregulation. The combination of lower regulatory costs, lower corporate taxes and lower financing costs could give the economy a meaningful boost.

4. It’s a drilling party! … but will anyone RSVP?

Trump sees traditional (thermal) energy as a pro-growth job creator. He will likely restore land lease and offshore development sales to pre-Biden levels and has said he’ll approve all pending drilling permits (currently ~5,700).5 But that may not drive the spike in production he desires: a) nearly 7,000 approved permits aren’t being used, b) similar to his last time in office, a spike in new lease offerings wouldn’t occur until late in his term, and c) companies face the risk that rushed or under-vetted lease sales may be rescinded in the future. Offshore drilling may be even harder to turbocharge, as development timelines are longer.6

Implications: While oil and gas stocks might rally, don’t expect a significant near-term earnings bump from Trump’s policies. Energy transition and EV stocks may briefly slump over grumbling about the Inflation Reduction Act and risks of tariff disruptions to supply chains. However, strong state backing, Big Tech’s preferences and private market funding make a clean energy retreat unlikely. Solar, wind and storage are proven energy technologies that boast clear advantages over thermal: They’re faster to build, use free fuel and have lower running costs, making them economically favorable for sponsors and developers.

5. Immigration controls limited by prohibitive costs, logistics and economic disruption

Delivering on Trump’s pledge to deport all 11 million7 undocumented immigrants would require massive funding—somewhere in the ballpark of $220 billion, assuming an average cost of $20k8 per deportee—which would likely exceed the appetite of even a willing Congress. Logistical challenges would include hiring thousands of new border agents and immigration judges, building detention facilities, coordinating with state and local law enforcement, deploying the National Guard, and reassigning federal workers. Furthermore, deporting what amounts to 4.8%7 of the U.S. workforce would result in significant economic upheaval, higher inflation pressures, lower tax revenues, and ripple effects to consumption. A more feasible scenario is a framework similar to the proposed-then-killed bipartisan Border Act of 2024.

Implications: A unified Congress will offer a smoother pathway for additional funding, though likely on a smaller scale given the immediate focus on tax cuts. We estimate Trump’s immigration and tariff policies may reduce GDP by around 0.5% in 2025.

Closing thoughts: Markets are nonpartisan—it’s the economy that matters

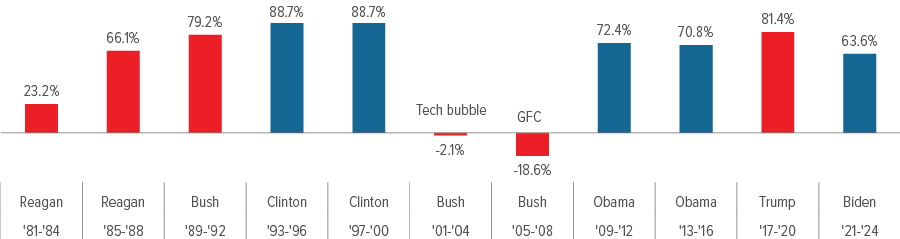

U.S. companies have a history of skillfully managing their way through different political climates, resulting in strong returns under both Republican and Democratic administrations (with one recent notable exception).

With the election over, markets can refocus their attention on macroeconomic data and corporate earnings. The U.S. economy is in strong shape, with consumer and government spending propelling GDP at a 2.8% annual rate in the third quarter. Inflation is trending down, wage growth remains manageable, and the Federal Reserve remains in the early stages of rate cuts. Despite some unusual patterns playing out in the post-Covid business cycle, we aren’t seeing the kind of buildup of excess that typically precedes a significant recession.

Implication: Don’t let politics derail your investment strategy.

As of 10/23/24. Source: FactSet, Voya IM. Past performance is no guarantee of future results.