Fed Chair Powell’s quip puts stagflation talk in context: GDP is bubbling along and inflation is on a yearlong cooling path, giving bond investors reason for optimism.

In his May FOMC press conference, Federal Reserve Chair Jerome Powell addressed a question on concerns about stagflation. The backdrop for the query was a first-quarter GDP report showing 1.6% annualized growth that was later lowered to 1.3%, and several consecutive higher-than-expected inflation readings. How real is the threat? Let’s take a look at each side of the term.

Stag-nation? Or just a blip?

Yes, first-quarter growth raised concerns, as it slowed more than forecasted. But placing it in a broader economic context offers a nuanced perspective that we believe is less worrisome:

1. GDP growth in the previous two quarters was surprisingly high, so the recent lower growth rate could represent a return to more typical levels. For context, the average GDP growth rate in the five years before the pandemic was 2%.

2. The Fed’s recent cycle of interest rate hikes was designed to temper economic activity. The full impact of these measures is still working its way through the economy.

3. While it’s common for investors to view a single data point as the start of a new trend, these data are reflective of a short, finite period and tend to be revised retrospectively. We believe it’s prudent to monitor the data, but we caution against making rash decisions based on one reading.

Recent ‘flation is disinflation

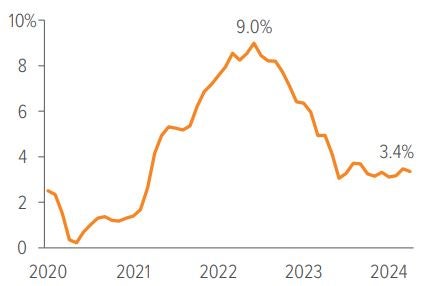

While the surge in inflation to 40-year highs has drawn comparisons to the 1970s, the similarities stop there. After price growth increased from a low of 1.4% to 9.0% over an 18-month period (from the start of 2021 to mid-2022), inflation has since decreased, stabilizing in the range of 3.0–3.5%. So, while it’s above the Fed’s target of 2%, inflation is well off its 2022 highs; in a historical context, we don’t consider it to be persistently high (Exhibit 1)

As of 04/24. Source: St. Louis Fed. Data represent the monthly, seasonally adjusted annual percentage change of the Consumer Price Index for all Urban Consumers.

We feel confident that inflation will move towards the Fed’s target, although it may be a bumpy ride. Lagging sectors, such as housing, may cloud the near-term picture, but labor market slack and more balanced goods/services spending support the likelihood of long-term disinflation, barring unexpected supply disruptions.

Bonds don’t need rate cuts to perform well

Stagflation is rare, but the potential risk exists. Despite not seeing signs of stag or ‘flation right now, we’ve been fielding questions about how this ‘70s throwback could potentially affect bond portfolios. In general, stagnant economic growth poses challenges for many financial assets (stocks and bonds included), while inflation causes the real value of future cash flows from bonds to diminish.

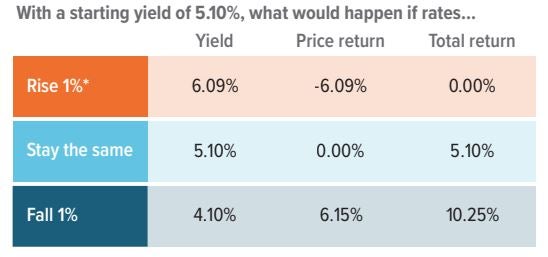

Today’s real yields are appealing, and the next Fed move will likely be lower, which should boost bond prices. But the bond market doesn’t need rate cuts to deliver solid returns. For example, if rates remain steady, the return (all else being equal) is simply the coupon, which was 5.1% for the U.S. Agg as of May 31, 2024. If the Fed aggressively cuts rates, high-quality bonds have the potential to generate double-digit returns (Exhibit 2). At the other end of the spectrum, interest rates would need to rise by more than 1% to produce a negative return.

These scenarios represent different ends of a range of potential returns for high-quality bonds. Importantly, in most scenarios, the total return for bonds looks attractive.

As of 05/31/24. Source: Bloomberg Index Services Limited, Voya IM. For illustrative purposes only. Calculations based on the U.S. Agg current duration of 6.15 years and assume immediate parallel shift in yield curve, with the new yield then earned for the 12-month period. *Calculations based on a 0.99% rise in interest rates to achieve a breakeven return. Some bonds in the index carry credit risk and therefore pose a higher risk than Treasury securities, which are guaranteed as to the timely payment of principal and interest. Investors cannot invest directly in an index.

A note about risk The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |