Global growth slows under the weight of tariffs, but fiscal stimulus, AI-driven productivity, and corporate strength keep equities in the driver’s seat.

Quick take

In 2025, the U.S. economy has shown resilience despite challenges from government policies. Inflation has eased but is still under pressure by tariffs, and labor markets are in a period of low hiring, low firing.

While these forces may challenge markets in the near term, strong U.S. earnings growth, durable large-cap balance sheets, and stock buybacks are helping support equities. Looking ahead, we expect innovation, productivity growth, and lower interest rates from the Fed to reinforce U.S. economic leadership—making large company stocks and high-quality bonds attractive options.

Tactical indicators

Economic growth (moderating)

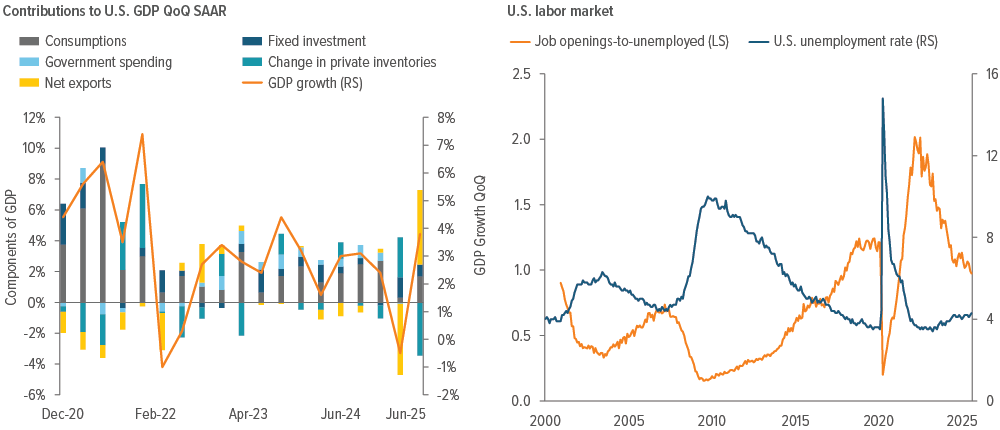

U.S. real GDP bounced back in 2Q25 growing by 3.3% (Exhibit 1). The Atlanta Fed GDPNow “nowcast,” which is corroborated by soft data, estimates 3Q25 will remain above 3%, driven by expected improvements in private investment and declining imports.

Fundamentals (positive)

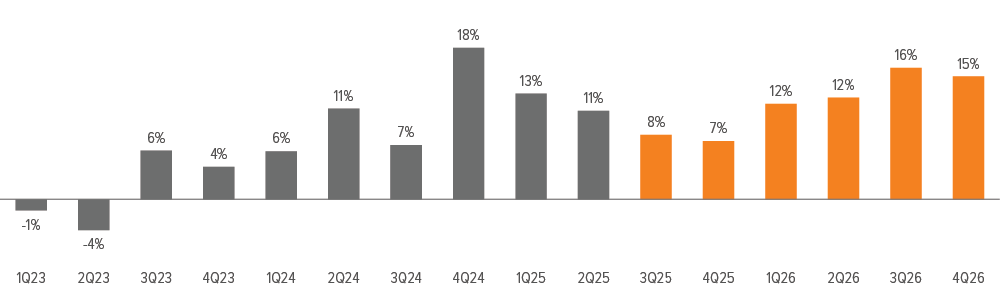

2Q25 year-over-year S&P 500 earnings grew by over 13%, with 8 of 11 sectors growing earnings.1 Technology and communications sectors continued to lead, with the “Magnificent 7” recording earnings growth of over 25%, compared with ~8% for the remining 493 companies.

Valuations (stretched)

U.S. equity valuations remain elevated, particularly for large-cap stocks, as the S&P 500 hit a record price-to-sales ratio. This environment places significant pressure on companies to sustain lofty profit margins. Despite this challenge, the justification for these valuations stems from the robust quality of earnings and the ongoing innovation cycle, especially in sectors that are closely tied to productivity enhancements and infrastructure investment.

Sentiment (neutral)

Sentiment indicators suggest there is considerable enthusiasm among investors at this time. However, these levels of optimism are not consistent with major market tops.

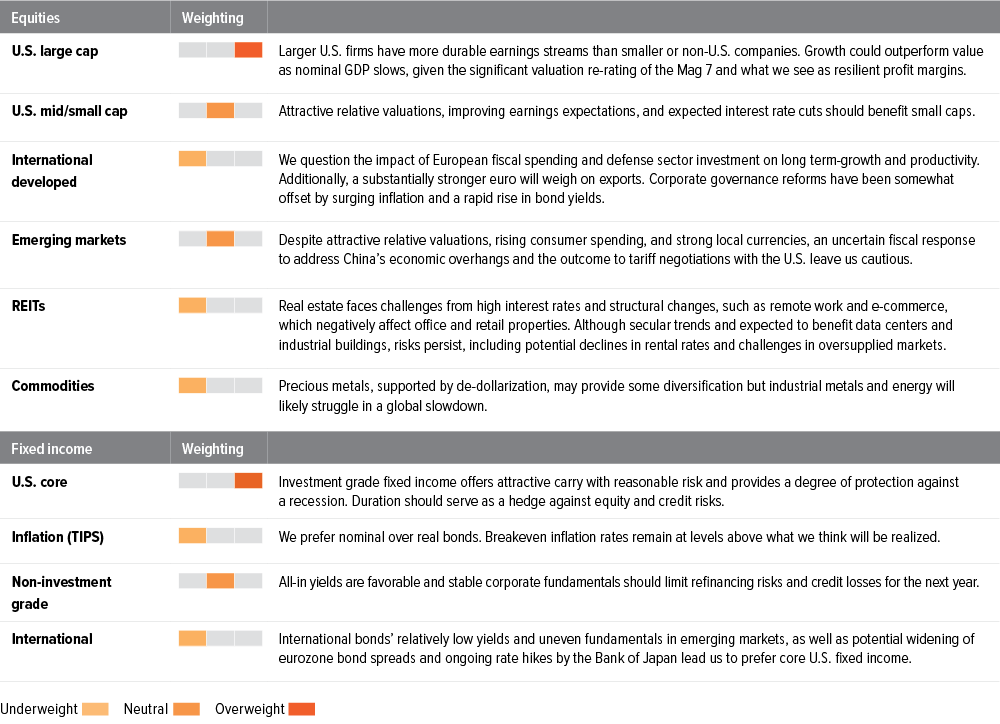

Portfolio positioning

We are modestly biased toward stocks over bonds, with a preference for U.S. large cap equities and high-quality fixed income.

Inflation has made notable progress over the past few years, with the core personal consumption expenditures (PCE) halving from a cycle high of 5.6% in September 2022 to a 12-month average of 2.8%. Services inflation remains the key driver of overall price pressures. However, recent declines in shelter and transportation services suggest a more constructive trend.

Despite the encouraging developments, the outlook for inflation warrants caution. Tariffs are projected to rise from 12% to 19% by year-end, which may have a more pronounced effect on consumer prices. While goods prices may continue to rise in the near term due to these tariff pressures, we believe the effects will be short-lived. Unlike during the pandemic, consumers today are more price sensitive and possess less discretionary spending power, which is likely to dampen demand and limit the persistence of goods-related inflation.

Since economic activity is highly dependent on the consumer, we are watching the labor market closely. The labor market is softening; hiring has slowed and the ratio of job vacancies to unemployed persons continues to decline (Exhibit 2). This reduced labor demand is occurring alongside tighter immigration policies and an aging population,which are constraining labor supply. As a result, the breakeven employment point—which is the number of jobs that must be created to keep the unemployment rate steady—is lower. This period of low hiring, low firing will likely last until there is an economic shock. As the Fed ramps up an interest rate cutting cycle, we expect continued U.S. economic resilience with positive but moderating U.S. GDP growth.

As of 09/25/25. Source: Bloomberg, Voya IM.

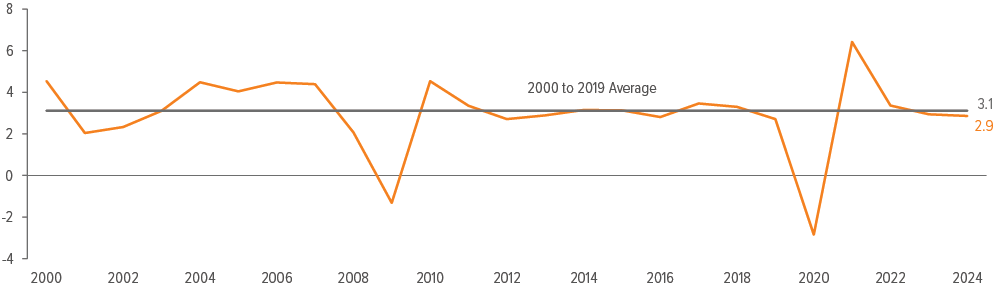

Outside the U.S., momentum is less convincing. Europe has relied on fiscal spending to prop up economic activity, but we don’t think the benefits will last. In addition, multiple countries continue to grapple with political instability, and the region faces intensifying competition from Asia. We see limited catalysts for a sustained acceleration in the region overall. The drags of elevated mortgage costs and higher business taxes are expected to weigh on U.K. consumers and companies for some time. Japan is relatively more attractive, with corporate reforms improving profitability, though political upheaval from Prime Minister Ishiba stepping down and the risk of faster rate hikes may limit upside. China’s recovery, in our view, is a weak link: Property sector stress and wary consumers have muted the impact of policy stimulus, leaving growth below potential and creating a headwind for broader Asia. Trade uncertainty and the country’s regulatory regime also influence investor optimism. At the same time, the offshore China equity market has a different composition than the overall economy and remains heavily overweight technology, a favorable sector in our opinion. Overall, we forecast ~3% global growth this year, which is roughly the average rate since 2000. (Exhibit 3).

As of 12/31/24. Source: Bloomberg, Voya IM.

Equities: U.S. large caps remain the most attractive

We believe equities remain more attractive than bonds or cash, led by U.S. large caps, which offer both durable balance sheets and consistent earnings power (Exhibit 4).

Within large caps, we maintain a balanced approach. Growth stocks benefit from innovation and AI adoption, while value-oriented companies, particularly financials and industrials, trade at relative discounts and may profit from policy support. The passage of the One Big Beautiful Bill Act (OBBBA) should support U.S. corporate activity by reducing corporate tax liability and potentially boosting investment spending. Small caps, despite a rally this summer, remain more vulnerable to tariffs and financing costs, leading us to favor larger cap companies.

Abroad, opportunities are thinner: Europe trades cheaply but lacks earnings momentum; the U.K. faces persistent macro drags; and, while Japanese fundamentals have improved, the rapid rise in inflation and political upheaval warrant caution. We remain neutral on emerging markets. While China equities are at 10-year highs, driven by liquidity and its technology sector, weak economic fundamentals such as soft consumer demand and declining home prices pose risks.

As of 09/10/25. Source: Bloomberg, Voya IM.

Fixed income: Use for defense

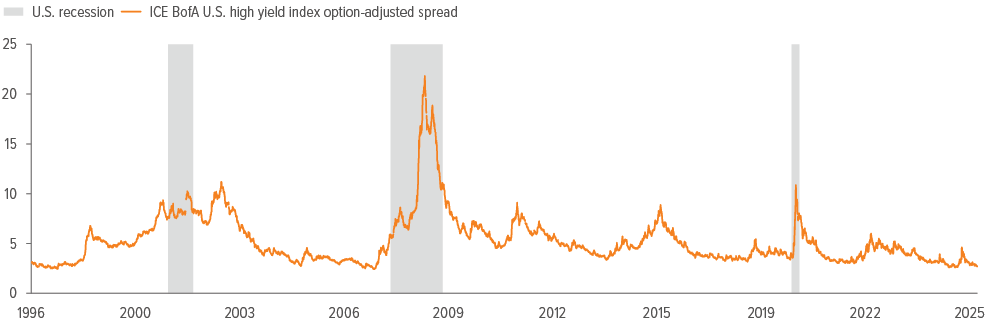

Treasuries remain attractive as a defensive anchor. With real yields currently in the 1.5-2.5% range, investors can access income and diversification opportunities that have been rare over the past decade. Credit spreads are near multi-decade lows (Exhibit 5), leaving carry as the main driver of returns. Given stretched valuations in riskier credit segments, we favor investment grade bonds over high yield. International bonds offer less compelling yields, and emerging market debt is challenged by uneven fundamentals, reinforcing our preference for core U.S. exposure.

As of 09/25/25. Source: Bloomberg, Voya IM.

Currencies and commodities: A nuanced story

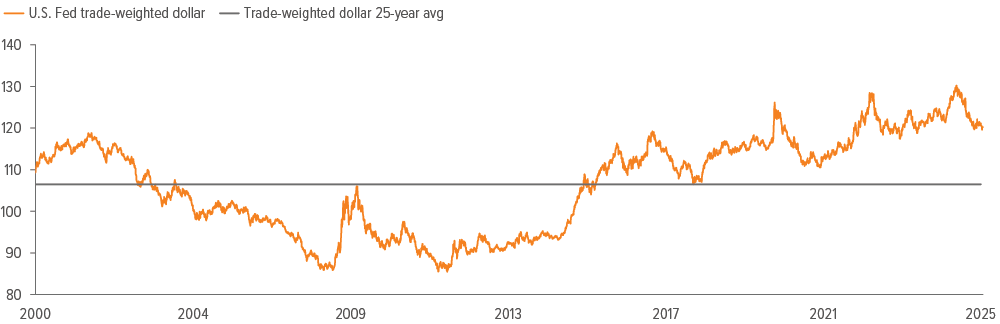

The U.S. dollar has declined by approximately 10% this year against a trade-weighted basket of currencies, yet it remains above its 25-year average (Exhibit 6). Valuation models based on purchasing power parity and real effective exchange rates suggest the dollar remains overvalued. Additionally, slower U.S. growth, expected monetary easing, and persistent trade deficits point to a gradual depreciation. However, the U.S. dollar should retain its safe-haven status during periods of global stress.

Commodities offer a more nuanced story. Oil prices are capped in the mid-$50s to $60s per barrel due to oversupply from OPEC+, U.S., and Latin American producers alongside tepid Chinese demand. In contrast, gold stands out as a hedge and beneficiary of a weaker dollar, while benefiting from central bank demand.

As of 09/25/25. Source: Bloomberg, Voya IM.