Against a backdrop of positive technicals and emerging late-cycle behavior, high starting yields should anchor returns once again in 2026.

Executive summary

Positive absolute returns, relative laggard in 2025

On a relative basis, senior loans trailed other credit sectors in 2025. Thematically, loans were subject to an uncertain macro backdrop, developing sectoral themes, and increased issuer bifurcation, even as technical conditions remained supportive and underlying fundamentals largely healthy. However, the asset class still delivered strong absolute returns for a third consecutive year, driven by coupons that remained historically elevated despite the continuation of rate cuts and nominal spread compression.

Key trends in 2025:

- Periodic volatility triggered episodes of secondary market weakness, most notably during the tariff-driven selloffs in March and April.

- Wide performance dispersion at both the single name and industry level was the major theme of U.S. loan performance in 2025.

- Technical tailwinds continued to buoy loans’ performance as record-breaking CLO issuance underpinned investor demand.

2026 outlook

Senior loans continue to offer attractive starting yields against a backdrop of solid macroeconomic conditions, stable corporate fundamentals, elevated coupons, muted repricing expectations, and only modest projected default activity. Conditions would need to deteriorate meaningfully beyond our base case to generate negative total returns in 2026.

- Technicals should continue to be a tailwind but could moderate due to stronger M&A activity.

- Defaults are expected to remain modest, but pockets of stress will continue to persist.

- Credit selection and monitoring will be key as risks from a bifurcated market are elevated despite a supportive macro environment.

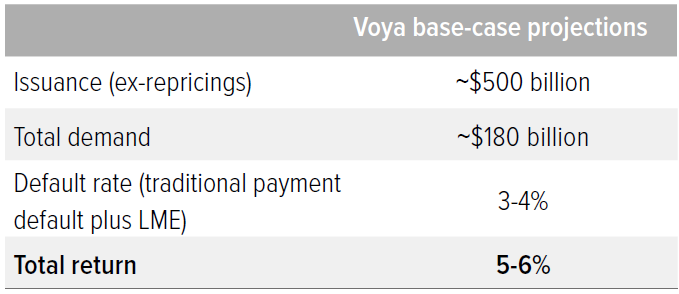

Our key projections for 2026

While future performance cannot be guaranteed, we forecast potential total returns for loans in the 5-6% range in 2026, broadly in line with the asset class’s long-term historical track record.

A note about risk: Principal risks for senior loans: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield. Voya’s senior loan strategies invest primarily in below investment grade, floating rate senior loans (also known as “high yield” or “junk” instruments), which are subject to greater levels of liquidity, credit and other risks than are investment grade instruments. There is a limited secondary market for floating rate loans, which may limit a strategy’s ability to sell a loan in a timely fashion or at a favorable price. If a loan is illiquid, the value of the loan may be negatively impacted and the manager may not be able to sell the loan in order to meet redemption needs or other portfolio cash requirements. The value of loans in the portfolio could be negatively impacted by adverse economic or market conditions and by the failure of borrowers to repay principal or interest. A decrease in demand for loans may adversely affect the value of the portfolio’s investments, causing the portfolio’s net asset value to fall. Because of the limited market for floating rate senior loans, it may be difficult to value loans in the portfolio on a daily basis. The actual price the portfolio receives upon the sale of a loan could differ significantly from the value assigned to it in the portfolio. The portfolio may invest in foreign instruments, which may present increased market, liquidity, currency, interest rate, political, information and other risks. These risks may be greater in the case of emerging market loans. Although interest rates for floating rate senior loans typically reset periodically, changes in market interest rates may impact the valuation of loans in the portfolio. In the case of early prepayment of loans in the portfolio, the portfolio may realize proceeds from the repayment that are less than the valuation assigned to the loan by the portfolio. In the case of extensions of payment periods by borrowers on loans in the portfolio, the valuation of the loans may be reduced. The portfolio may also invest in other investment companies and will pay a proportional share of the expenses of the other investment company.